maswebmas.ru Categories

Categories

Prepare For Coding Interview In One Month

Before getting into the meat of the post, I will first clarify some points and then talk a little bit about who I consider to be an average. Data structures and algorithms often constitute many of the more difficult questions in a coding interview. These complex topics take a lot of reviews. A simple, yet effective, approach is to do 1 easy and 1 medium problem each day & also 1 hard problem per each week. By the end of the month you will have. How to best prepare for a coding interview? · Choose an appropriate programming language. · Plan your time and tackle topics and questions in. Ace Your Coding Interview in One Month: A Strategic Approach · Week 1: Brush Up on Fundamentals · Week 2: Advanced Topics and Problem Patterns. I would go through 12–15 questions, practicing for two hours every day. This meant that I could solve + problems within one month. Using this routine, I was. A piece of advice look for design questions. Also be ready to apply coding concepts in whatever language you are coding in. Database concepts + A little practice on SQL. · Spring Boot/ Any other framework that you are proficient in. · Java / Any other programming language you are. I have one month to prepare for the next technical interview and I honestly need to learn everything. I mean I know how to code so I can do simple data. Before getting into the meat of the post, I will first clarify some points and then talk a little bit about who I consider to be an average. Data structures and algorithms often constitute many of the more difficult questions in a coding interview. These complex topics take a lot of reviews. A simple, yet effective, approach is to do 1 easy and 1 medium problem each day & also 1 hard problem per each week. By the end of the month you will have. How to best prepare for a coding interview? · Choose an appropriate programming language. · Plan your time and tackle topics and questions in. Ace Your Coding Interview in One Month: A Strategic Approach · Week 1: Brush Up on Fundamentals · Week 2: Advanced Topics and Problem Patterns. I would go through 12–15 questions, practicing for two hours every day. This meant that I could solve + problems within one month. Using this routine, I was. A piece of advice look for design questions. Also be ready to apply coding concepts in whatever language you are coding in. Database concepts + A little practice on SQL. · Spring Boot/ Any other framework that you are proficient in. · Java / Any other programming language you are. I have one month to prepare for the next technical interview and I honestly need to learn everything. I mean I know how to code so I can do simple data.

Live Sessions · First Half. In the first half, we pick a system design topic and do a deep dive. We discuss the topic and several members share their expertise. If you want to prepare to crush the coding interview: Give yourself three months of focused study before you even apply for any jobs. Set aside hours per. It depends on the interview type you select. For Data Structures & Algorithms interviews, you will be preassigned a coding question to ask your partner. We. I would go through 12–15 questions, practicing for two hours every day. This meant that I could solve + problems within one month. Using this routine, I was. Month 1. The first month should be dedicated to learning the data structures, concepts, and algorithms mentioned above. If you don't know the data structures. Learn Data structures and algorithms. Solve on paper first. Write clean code. Ask for help. You tries to doing work hard practice more questions. Cracking the Coding Interview one month challenge | software engineering. Maya Bello. 4 videosLast updated on Jan 18, First, study core data structures, especially binary trees. Make sure you can construct, insert, delete, and find in the binary tree. · Next. Month 9, 10, 11, A mix of medium and hard questions in your preferred website. Practice by participating in contests, focusing on topics that you are weak. Live Sessions · First Half. In the first half, we pick a system design topic and do a deep dive. We discuss the topic and several members share their expertise. This is my multi-month study plan for becoming a software engineer for a large company. Required: A little experience with coding (variables, loops, methods/. Weeks 6, 7, 8 — Practice more complex coding interview problems Now that you've been practicing more straightforward problems for a couple of weeks, it's time. prepare. Get "Elements of Programming Interviews" and give yourself 2 months to prepare. Start to with "1-month" plan in the book spending at least an hour. This Interview Preparation Kit has challenges curated by our experts for you to prepare and ace your interview in 3 months' time. Progress. Challenges: 0/0. How to Use Sample Coding Problems · Write the solution again in another programming language. This forces you to think through the abstractions again, and helps. This Interview Preparation Kit has challenges curated by our experts for you to prepare and ace your interview in a month's time. Progress. Challenges: 0/0. But because the purpose of these interviews is to weed out the sub-par candidates in a limited amount of time, expect your interviewer to jump straight into. There's nothing more frustrating than opening an interview prep book, only to find a bunch of solutions in a programming language that you don't know. That's. Three months is a solid amount of time to prepare for a coding interview, and with dedication and smart planning, you can certainly crack it. TAGS. Research the types of interviews you can expect, such as technical interviews, coding interviews, system design interviews, and behavioral interviews.

What Defense Stocks To Buy

Best Defense Stocks To Buy · An Overview of the Defense Industry · Northrop Grumman Financials Are Solid · Boeing Has Run Into Trouble · Lockheed Martin Is The. INDIA IS INVESTING IN DEFENCE, ARE YOU? · 5 YEAR INDEX RETURNS CAGR OF OVER 58% · PURE EXPOSURE TO DEFENCE STOCKS · SECTOR IS DRIVEN BY MAKE IN INDIA INVITIATIVE. Best Aerospace and Defense Stocks · Lockheed Martin (NYSE:LMT) · Honeywell Intl (NASDAQ:HON) · General Dynamics (NYSE:GD) · Airbus (OTCPK:EADSY) · Boeing (NYSE:BA). Recycling of strategic materials from end-of-life Government items; Disposal of excess stocks for operational funding. Our Offices. The Defense Logistics Agency. Top Performing Companies ; BYRN Byrna Technologies Inc. ; LUNR Intuitive Machines, Inc. ; AIRI Air Industries Group. ; RDW Redwire Corporation. I keep an eye on them and buy them whenever they are down more than 10%, then sell them when they get back to their highs. Upvote. List of Top Defence Stocks in India · Hindustan Aeronautics Ltd · Bharat Electronics Ltd · Data Patterns · Bharat Earth Movers Limited (BEML) · Paras defence and. The Best Self-defense stocks to buy now according to AI include RGR Sturm, Ruger & Co., Inc., SWBI Smith & Wesson Brands Inc and AOUT American Outdoor. Best Defense Stocks · Axon Enterprise · Embraer · Kratos Defense & Security Solutions · L3Harris Technologies · Ouster · General Dynamics · Raytheon Technologies. Best Defense Stocks To Buy · An Overview of the Defense Industry · Northrop Grumman Financials Are Solid · Boeing Has Run Into Trouble · Lockheed Martin Is The. INDIA IS INVESTING IN DEFENCE, ARE YOU? · 5 YEAR INDEX RETURNS CAGR OF OVER 58% · PURE EXPOSURE TO DEFENCE STOCKS · SECTOR IS DRIVEN BY MAKE IN INDIA INVITIATIVE. Best Aerospace and Defense Stocks · Lockheed Martin (NYSE:LMT) · Honeywell Intl (NASDAQ:HON) · General Dynamics (NYSE:GD) · Airbus (OTCPK:EADSY) · Boeing (NYSE:BA). Recycling of strategic materials from end-of-life Government items; Disposal of excess stocks for operational funding. Our Offices. The Defense Logistics Agency. Top Performing Companies ; BYRN Byrna Technologies Inc. ; LUNR Intuitive Machines, Inc. ; AIRI Air Industries Group. ; RDW Redwire Corporation. I keep an eye on them and buy them whenever they are down more than 10%, then sell them when they get back to their highs. Upvote. List of Top Defence Stocks in India · Hindustan Aeronautics Ltd · Bharat Electronics Ltd · Data Patterns · Bharat Earth Movers Limited (BEML) · Paras defence and. The Best Self-defense stocks to buy now according to AI include RGR Sturm, Ruger & Co., Inc., SWBI Smith & Wesson Brands Inc and AOUT American Outdoor. Best Defense Stocks · Axon Enterprise · Embraer · Kratos Defense & Security Solutions · L3Harris Technologies · Ouster · General Dynamics · Raytheon Technologies.

Visa, Altria and Wendy's are three ideal defensive stocks to buy on the dip for stable returns amid market volatility. Other industries. Visa, Altria and Wendy's are three ideal defensive stocks to buy on the dip for stable returns amid market volatility. Other industries. Paras Defence Share Price: Find the latest news on Paras Defence Stock Price Buy. Buy. Outperform. Hold. Underperform. Sell. Earnings Forecast. Actuals. buy more weapons. This is on top of the $ billion the U.S. already gives to the Israeli military annually. Israel is required to use this money to buy. List of Top Defence Stocks in India · Hindustan Aeronautics Ltd · Bharat Electronics Ltd · Data Patterns · Bharat Earth Movers Limited (BEML) · Paras defence and. Track the latest news and stocks to watch in the defense and aerospace industry, including Boeing, Lockheed Martin and Northrop Grumman. 1. Innovative Solutions & Support (NASDAQ:ISSC). Innovative Solutions & Support (NASDAQ:ISSC) is the most undervalued defense stock based on WallStreetZen's. Compare the top Aerospace and Defense stocks on statistics like market cap and valuation. Click here to see a detailed comparison of LMT, RTX, BA and more. Q. Do defense stocks perform well during wartime? A. War Profiteering: You Should Have Bought Defense Stocks When The War Started > The. Brady Corporation(NYSE:BRC): The rising geopolitical conflicts, increasing defense budgets, and use of advanced technologies are boosting the long-term. Aerospace & Defense Dividend Stocks, ETFs, Funds ; LOCKHEED MARTIN CORPORATIONLOCKHEED MARTIN. LMT · $ +%. $ B ; GENERAL DYNAMICS CORPORATION. Defensive stocks, in my point of view, simply means stock whose price is more stable than sp during market fluctuation or crash, but growth is usually. We acknowledge the defense industry's essential role in national security, and we do not think that defense stocks are incompatible, per se, with ESG criteria. What are the top gainers and top losers within the defence sector today? - Lockheed Martin Corporation: These guys are all about aerospace and defense. They're known for their cutting-edge technology and military. Analyst Ratings ; Elbit Systems Ltd. stock logo. ESLT. Elbit Systems. N/A, N/A ; The Boeing Company stock logo. BA. Boeing. Moderate Buy ; General Dynamics. Anyone who says stocks in the defense industry is haram is either not thinking it through or being ridiculous. Having read the comments I see a few people talk. Welcome to the Department of Defense Office of Financial Readiness website! Look around, discover helpful tips and check back often for updates! Defensive stocks are also called non-cyclical stocks, as they are less prone to the economic cycle of expansions and recessions. Defensive stocks will come with. I keep an eye on them and buy them whenever they are down more than 10%, then sell them when they get back to their highs. Upvote.

Draw Period For Heloc

A HELOC is a line of credit borrowed against the available equity of your home. Your home's equity is the difference between the appraised value of your home. We cannot adjust the due date for HELOC loans. You do have a day grace period to make a payment before the loan is considered in default. Can I make my. The HELOC draw period is usually 10 years, where you can withdraw funds up to your limit. The repayment period is when you can no longer borrow from your. The draw period is when you can borrow money against the home equity credit line without having to pay back the principal. Instead, you only have to repay the. The HELOC end of draw period is when you enter the repayment phase of your line of credit. You are now required to begin paying back the principal balance in. At the end of your draw period your account will rollover into the repayment period automatically. For detailed information on how this will affect your payment. After the draw period ends, the HELOC enters the repayment period, which can last 10 to 20 years. During this time, a homeowner typically can no longer draw. The repayment period is 15 years. The new monthly payment includes principal and interest with the repayment not exceeding months. Note: The APR continues. All HELOCS have a “draw period” (typically years) and a “repayment period” (typically up to 20 years). Be sure to ask your lender about repayment terms so. A HELOC is a line of credit borrowed against the available equity of your home. Your home's equity is the difference between the appraised value of your home. We cannot adjust the due date for HELOC loans. You do have a day grace period to make a payment before the loan is considered in default. Can I make my. The HELOC draw period is usually 10 years, where you can withdraw funds up to your limit. The repayment period is when you can no longer borrow from your. The draw period is when you can borrow money against the home equity credit line without having to pay back the principal. Instead, you only have to repay the. The HELOC end of draw period is when you enter the repayment phase of your line of credit. You are now required to begin paying back the principal balance in. At the end of your draw period your account will rollover into the repayment period automatically. For detailed information on how this will affect your payment. After the draw period ends, the HELOC enters the repayment period, which can last 10 to 20 years. During this time, a homeowner typically can no longer draw. The repayment period is 15 years. The new monthly payment includes principal and interest with the repayment not exceeding months. Note: The APR continues. All HELOCS have a “draw period” (typically years) and a “repayment period” (typically up to 20 years). Be sure to ask your lender about repayment terms so.

The minimum payment during the draw period is interest-only. End-of-Draw Date (Repayment Period) – The date at which the draw period ends on a HELOC and. If you have a home equity line of credit (HELOC), you can access (or “draw”) funds from your line up to your credit limit for a certain number of years. This is. the initial draw period which can last up to 10 years, and; the repayment period which can last 10–20 years. Term: HELOCs usually have a 20–30 year term, which. The HELOC draw period is usually 10 years, where you can withdraw funds up to your limit. The repayment period is when you can no longer borrow from your. A HELOC has two phases: the draw period and the repayment period. One is for spending the money and one is for paying it back. Typically, you're only required to make interest payments during the draw period, which tends to be 10 to 15 years. HELOCs function much like a credit card: You can withdraw as many times as you like, within your credit limit. (Some lenders also have a minimum draw amount). This means you can borrow against it again if you need to, and you can borrow as little or as much as you need throughout your draw period (typically 10 years). A HELOC has 2 different phases, a draw period and a repayment period. o The draw period is the initial 10 years of the loan, when you have ongoing access to. HELOCs have a draw period, during which the borrower can use the line, and a repayment period during which it must be repaid. Draw periods are usually 5 to. The standard draw period on a HELOC is usually 10 years. But, yours After this date, the HELOC will transition from the draw period to the repayment. After this date, the HELOC will transition from the draw period to the repayment period, in which you no longer withdraw any funds and your monthly payments . During the draw period, the first 5 years - you pay interest on whatever amount of money you have drawn from HELOC. You can repay some or all of the drawn. HELOCs include a draw period of several years, where the borrower can use the line of credit as they see fit and generally are only required to make. Your home equity line of credit, or HELOC, has an established draw period. During that time you have the ability to borrow from your available line of credit. Our HELOC is a year loan. You will be able to borrow money any time during the year draw period. Interest will accrue on any money you take out, and. During the draw period, which can last anywhere from five to ten years, you can borrow funds from your line of credit and make interest-only payments. Interest-. Once approved for a HELOC, you can generally spend up to your credit limit whenever you want. draw period ends you enter a repayment period. Your lender may. This phase typically lasts between 5 to 10 years and provides considerable flexibility in managing your finances. After the draw period ends, you enter the. The repayment period is 15 years. The new monthly payment includes principal and interest with the repayment not exceeding months. Note: The APR continues.

Home Loan Interest Rate In All Banks

At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Try different loan amounts, down payments, and interest rates to see how it changes monthly mortgage payments. Go To Mortgage Calculator. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage: Today. The average APR on the year fixed. Note 5 If all occupying borrowers have not owned a home in the past three years and plan to apply for a USAA Federal Savings Bank, Year Conventional Loan. The current national average 5-year ARM mortgage rate is down 4 basis points from % to %. Last updated: Saturday, August 24, See legal disclosures. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Try different loan amounts, down payments, and interest rates to see how it changes monthly mortgage payments. Go To Mortgage Calculator. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage: Today. The average APR on the year fixed. Note 5 If all occupying borrowers have not owned a home in the past three years and plan to apply for a USAA Federal Savings Bank, Year Conventional Loan. The current national average 5-year ARM mortgage rate is down 4 basis points from % to %. Last updated: Saturday, August 24, See legal disclosures. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %.

TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. All home lending products, including mortgage, home equity loans and home This Interest rate reduction is available on new KeyBank mortgage loan applications. View this list of the latest mortgage and home loan rates. Plus, with a rich history of community banking experience and local decisions on loans. Private Sector Banks ; Name of Lender. Current Home Loan Interest Rate ; Axis Bank. % – % ; Karur Vysya Bank. % – % ; Karnataka Bank. % –. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Axis Bank's Home Loan interest rates start from % for salaried and % for self-employed individuals. The bank also charges a nominal processing fee for. Based on the purchase of a single-family, primary residence, 80% loan- to-value (LTV), a credit score of , 15 days of prepaid interest and an interest rate. All rates are benchmarked to Policy Repo Rate. Current applicable Repo Rate = % *HDFC BANK does not source any Home Loan business from any Lending Service. Fees, points, mortgage insurance, and closing costs all add up. Compare Loan Estimates to get the best deal. Share this. The PMMS is focused on conventional, conforming fully-amortizing home purchase loans for borrowers who put 20% down and have excellent credit All content is. The average APR on a year fixed-rate mortgage rose 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 2 basis. For today, Monday, August 26, , the current average interest rate for the benchmark year fixed mortgage is %, falling 5 basis points over the last. Customized mortgage rates ; 7/6 ARM, % (%), $2, added to closing costs ; year fixed, % (%), $39 added to closing costs ; year fixed. Select mortgage loans are eligible for an interest rate discount of Rates may be higher or lower for different loan amounts, loan products. All loans are provided by PNC Bank, National Association, a subsidiary of PNC, and are subject to credit approval and property appraisal. equal housing lender. interest rate on your loan, you must meet all of the following criteria: (1) Your loan is one of the following fixed-rate mortgage loan products: Homebuyers. Your rate will depend on various factors including loan product, loan interest payments for the life of the loan because the interest rate never changes. Home Loans Interest Rates (Current) - Interest Rates · आवास ऋण ब्याज दर · %* p.a. onwards · Start From · % p.a.* · % p.a. · % p.a. · Starts. Farmers Bank of Kansas City logo. Farmers Bank of Kansas City. NMLS # U.S. News Rating. Interest Rate: %. APR: % · NBKC Bank logo. NBKC Bank. Term, Rate, APR, Principal & Interest Payment ; 15 Yr Fixed Purchase, %, %, $1, ; 30 Yr Fixed Purchase, %, %. $1,

Best Credit Score Building Credit Cards

16 partner offers · Capital One Quicksilver Secured Cash Rewards Credit Card · The OpenSky Secured Visa Credit Card · First Latitude Platinum Mastercard Secured. The Capital One QuicksilverOne card is one of our top choices for consumers trying to bolster their credit scores, thanks to a generous rewards program that. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event that you have a poor credit. Best Credit Cards to Build Credit · Retailer credit cards. If you're just starting out, it may be easier to get approved for a retailer's store credit card than. Since the credit-building journey can vary from person to person, it's important to know what options are available to help you boost your credit score. Cheese. Discover and US Bank are good options. Capital One has the Quicksilver secured as well, though that one is a bit harder to graduate. A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event that you have a poor credit. Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. · No Minimum Credit Score required; low fixed interest rate of %; Fully. 16 partner offers · Capital One Quicksilver Secured Cash Rewards Credit Card · The OpenSky Secured Visa Credit Card · First Latitude Platinum Mastercard Secured. The Capital One QuicksilverOne card is one of our top choices for consumers trying to bolster their credit scores, thanks to a generous rewards program that. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event that you have a poor credit. Best Credit Cards to Build Credit · Retailer credit cards. If you're just starting out, it may be easier to get approved for a retailer's store credit card than. Since the credit-building journey can vary from person to person, it's important to know what options are available to help you boost your credit score. Cheese. Discover and US Bank are good options. Capital One has the Quicksilver secured as well, though that one is a bit harder to graduate. A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event that you have a poor credit. Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. · No Minimum Credit Score required; low fixed interest rate of %; Fully.

What is a credit builder card? A credit builder card is a type of credit card specifically designed for people with low credit scores or who've never had a. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Best Credit Cards to Build Credit · Retailer credit cards. If you're just starting out, it may be easier to get approved for a retailer's store credit card than. The Capital One QuicksilverOne card is one of our top choices for consumers trying to bolster their credit scores, thanks to a generous rewards program that. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. Credit Cards for Bad Credit / Rebuilding Credit Score · Self - Credit Builder Account with Secured Visa® Credit Card · Revenued Business Card · OpenSky® Plus. Best for No Interest Charged: Credit Karma · Best for Long Repayment Terms: Credit Strong · Best Credit Union: Digital Federal Credit Union · Best for Small Loan. The Discover it® Secured Card can help you build credit with responsible use2, like making your payments on time and in full each month. Payment history is. Firstcard is the best secured credit card to build credit. No credit checks, pre-approved, 0% APR, apply without an SSN. Apply for your Firstcard today. Top credit builder cards ; Tesco Bank Foundation. - Clubcard points on spending. - % rep APR. Check eligibility ; Tesco Bank Foundation. - Clubcard points on. Showing 8 results. Add to compare. Best for building credit. Capital One Platinum Secured Credit Card. Bankrate score. Hover to learn more. Credit cards for bad credit ; Credit One Bank® Platinum Visa® for Rebuilding Credit · reviews ; Milestone® Mastercard® · reviews ; OpenSky® Secured Credit. Authorized users can build their credit history if the primary cardmember uses their card responsibly, like paying their bill on time and keeping a low credit. 18 partner offers ; Citi Double Cash Card · % - % (Variable) · 2% (cash back) · $0 ; Capital One QuicksilverOne Cash Rewards Credit Card · %-5% (cash. Building credit. Credit cards are among the most common types of credit offered to consumers. And your credit score serves as a gauge of your creditworthiness. Choose your own credit line – $ to $ – based on your security deposit · Build your credit score. · No minimum credit score required for approval! These are a great choice if you have no credit history and are also perfect for people rebuilding their credit. These cards usually require a minimum deposit. OneMain Financial BrightWay® Card · See if you're pre-approved with no impact to your credit score · Qualify for rewards like a credit limit increase (subject to. For example, Discover® and Capital One® offer secured cards that don't have an annual fee and allow you to make additional deposits to increase your credit line. A credit builder credit card is aimed at helping people who need to build up a credit history from scratch or get their credit rating back on track after being.

Asicminer Block Erupter

The Block Erupter USB connects to a computer via USB and is controlled by specialized mining software. When the mining process starts, the ASIC chip in the. SUPPORTED DEVICES Currently supported ASIC devices include Avalon, Bitfountain's Block Erupter series (both USB and blades), a large variety of Bitfury. The ASICminer USB block erupter is excellent if you're just starting out in your mining adventures or just need a little extra hashing power and don't want to. Their first product was the USB-based ASIC miner. The company was later acquired by ASICMINER. Brands Similar to Block Erupter. Antminer. Antminer is a brand of. Celebrate the history of Bitcoin with a desktop statue of the first ever USB-ASIC miner for BTC, the Block Erupter mh. This ancient bitcoin mining. ASICMINER Block Erupter MH/s - 4th Generation - ASIC USB Bitcoin Miner. Hardware interface USB Style Modern Item weight 5 Ounces UPC. Designed to be compact and user-friendly, it's capable of mining Bitcoin and various altcoins. By employing ASIC technology, the Asicminer Block Erupter USB. The Block Erupter USB series is the second major product of ASICMINER. It serves as a replacement for GPUs. They hash at a rate of + mh/s while drawing. This is the only existing complete collection of ASICMiner Sapphire Block Erupter USBs that has ever been shared online. The Block Erupter USB connects to a computer via USB and is controlled by specialized mining software. When the mining process starts, the ASIC chip in the. SUPPORTED DEVICES Currently supported ASIC devices include Avalon, Bitfountain's Block Erupter series (both USB and blades), a large variety of Bitfury. The ASICminer USB block erupter is excellent if you're just starting out in your mining adventures or just need a little extra hashing power and don't want to. Their first product was the USB-based ASIC miner. The company was later acquired by ASICMINER. Brands Similar to Block Erupter. Antminer. Antminer is a brand of. Celebrate the history of Bitcoin with a desktop statue of the first ever USB-ASIC miner for BTC, the Block Erupter mh. This ancient bitcoin mining. ASICMINER Block Erupter MH/s - 4th Generation - ASIC USB Bitcoin Miner. Hardware interface USB Style Modern Item weight 5 Ounces UPC. Designed to be compact and user-friendly, it's capable of mining Bitcoin and various altcoins. By employing ASIC technology, the Asicminer Block Erupter USB. The Block Erupter USB series is the second major product of ASICMINER. It serves as a replacement for GPUs. They hash at a rate of + mh/s while drawing. This is the only existing complete collection of ASICMiner Sapphire Block Erupter USBs that has ever been shared online.

ASICMiner Block Erupter Blade gh/s Miner (Rev2) - Discount Pricing until the last day we will be able to ship prior to the holiday break. In stock now!ASICMiner Block Erupter Ethernet Controller Revision This is the Ethernet controller to get the Block Erupter Prisma Rev. online. Asicminer Block Erupter Usb Asic Bitcoin Miner Features · Heat reduction: mA (sapphire). · Stability: No unexpected (non-probabilistic) HW errors. Shop ASICMiner Block Erupter USB MH/s Sapphire Miner online at best prices at desertcart - the best international shopping platform in Philippines. A block erupter will do MH/s. Total hashrate is currently about EH/s = ,,,, MH/s. Your chance of winning any given block. Open Source BitCoin Mining Device powered by ASICMiner chips - Block Erupter. Their first product was the USB-based ASIC miner. The company was later acquired by ASICMINER. Brands Similar to Block Erupter. Antminer. Antminer is a brand of. ASICMiner Block Erupter CUBE Specs: Speed: 30 Gh/s Guaranteed, Gh/s theoretical when overclocked. Power Consumption: Approx. W, approx. The ASIC Block Erupter is now an outdated product for Bitcoin mining. It can still mine other SHA alt coins like Terracoin, PPCoin and Namecoin which have. Live income estimates of all known ASIC miners, updated every minute. ASIC USB Block Erupter Bitcoin Miner MH/s Matte Black Tested Awesome Miner! Pre-Owned · ASIC Miner. ILS. All these site I post here are free to join. ASICMiner Block Erupter USB MH/s Sapphire Miner. $Price. Quantity. Add to Cart. Ohio-Bitcoin. One - asic bitcoin miner usb block erupter, - Shop for customer-focused China wholesale one - asic bitcoin miner usb block erupter and one - asic bitcoin. ASICMINER BLOCK ERUPTER USB MH/s Sapphire Miner (Pink) - $ FOR SALE! For sale is a USB stick miner. Works fine and looks nice. Buy ASICMiner Block Erupter USB MH/s Sapphire Miner in Singapore,Singapore. Used for mining cyptocurrency. With a hashrate of MH/s you are able to. ASICMINER Block Erupter MH/s - 4th Generation - ASIC USB Bitcoin Miner, B00CUJT7TO, , , USB BE Rev. Buy ASIC Miner Block Erupter USB Drive from NS Services for best price at Rs / Find Company contact details & address in Kurukshetra. Follow. ASICMiner Block Erupter Blade gh-s Miner bitcoin miner. Done. Upgrade to Flickr Pro to hide these ads. Loading comments Add comment. A set of 3 ASIC USB Block Erupter Bitcoin Miners MH/s. One is black and two are red. They come with their original cases. I have not mined in years. I have. Follow. ASICMiner Block Erupter Blade gh-s Miner bitcoin miner. Done. Upgrade to Flickr Pro to hide these ads. Loading comments Add comment.

What Is Short Selling Stock

Short selling is a regulated and widely used strategy. Investors use short selling when they believe, based on fundamental research, that a stock price is. Short selling is an investment or trading strategy that speculates on the decline in a stock or other security's price. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. The primary risk of. Short selling is a popular kind of trading strategy in which investors speculate on a stock price's decline. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. Short selling is—in short—when you bet against a stock. You first borrow shares of stock from a lender, sell the borrowed stock, and then buy back the shares. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. What is short selling? Quite simply, short selling is selling a stock that you don't already own. There are rules in place to require a stock to. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that the seller has borrowed. Short selling is a regulated and widely used strategy. Investors use short selling when they believe, based on fundamental research, that a stock price is. Short selling is an investment or trading strategy that speculates on the decline in a stock or other security's price. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. The primary risk of. Short selling is a popular kind of trading strategy in which investors speculate on a stock price's decline. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. Short selling is—in short—when you bet against a stock. You first borrow shares of stock from a lender, sell the borrowed stock, and then buy back the shares. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. What is short selling? Quite simply, short selling is selling a stock that you don't already own. There are rules in place to require a stock to. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that the seller has borrowed.

Short selling works by borrowing shares – usually from a broker or pension fund – and selling them immediately at the current market price. Later, you'd close. Short selling means that you expect the price of a stock to fall, then you sell some borrowed shares at a higher price, hoping to buy the same number of shares. Selling short means selling stock you don't have, hoping to buy it back later cheaper. So if you sell for $10 a share and buy it back for $5 a. The aim of short selling is to profit on a stock when the price decreases. To enter a short sell position, you “borrow” a stock and sell it. The short seller borrows shares and immediately sells them. The short seller then expects the price to decrease, after which the seller can profit by purchasing. Short selling involves the sale of equity stocks that aren't owned by the seller, but are borrowed from a broker for a short sale. The investor pays the broker. Shorting a stock is a way for investors to bet that a particular stock's future share price will be lower than its current price. Short selling is a trading strategy to profit when a stock's price declines. While that may sound simple enough in theory, traders should proceed with caution. The traditional method of shorting stocks involves borrowing shares from someone who already owns them and selling them at the current market price – if there. Short selling is the process by which an investor sells borrowed securities from a brokerage in the open markets, expecting to repurchase the borrowed. Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. A “short” position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. Put simply, a short sale involves the sale of a stock an investor does not own. When an investor engages in short selling, two things can happen. If the price. To sell short, you sell shares of a security that you do not own, which you borrow from a broker. After you short a position via a short-sale, you eventually. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. Shorting stocks outright, or via short call or long put options gives you exposure based on your speculation that the market will go down. When you go short, you expect a stock price to decrease. You borrow the stock from your broker's inventory, the shares are sold, and proceeds are credited to. Selling stock short means borrowing stock through the brokerage firm and selling it at the current market price, which the short seller believes is due for a. How to short a stock · Apply and qualify for a margin account with your brokerage. · Next, apply and qualify to add short selling to your margin account.

What Is The Penalty For Taking 401k Early

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. However, there are exceptions to this early distribution. The early withdrawal penalty is typically a one-time fee that is applied to each distribution from the k plan before the age of 59 1/2. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Also, a 10% early withdrawal penalty generally applies on distributions before age 59½ for IRAs and (k)s, unless you meet one of the IRS exceptions. If. An early withdrawal or an early distribution is when you withdraw money from your IRA, (k) or any With certain exceptions the IRS charges a 10% penalty on. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. Also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the IRS exceptions. Sign up for Fidelity Viewpoints weekly. If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. However, there are exceptions to this early distribution. The early withdrawal penalty is typically a one-time fee that is applied to each distribution from the k plan before the age of 59 1/2. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Also, a 10% early withdrawal penalty generally applies on distributions before age 59½ for IRAs and (k)s, unless you meet one of the IRS exceptions. If. An early withdrawal or an early distribution is when you withdraw money from your IRA, (k) or any With certain exceptions the IRS charges a 10% penalty on. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. Also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the IRS exceptions. Sign up for Fidelity Viewpoints weekly.

But even though this is technically your money, withdrawing it before age 59 1/2 could increase your taxable income and, in turn, your tax bill. The Bottom Line. Withdrawal Penalty: What It Is, How It Works, Example · What Is the (k) Early Withdrawal Penalty? Early withdrawals from a (k) account (i.e., before age. Unless you qualify for an exemption, you will also owe a 10% early withdrawal penalty tax on the full amount when you file your taxes. . Alternatives to. If you withdraw funds from your (k) retirement plan before age 59½, you will likely be subject to a 10% early withdrawal penalty as well as taxes. You may. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception. Good on you for clearing debt. But be warned, that 10% early withdrawal penalty isn't assessed until the next years tax filing. Be prepared for. There is no penalty on hardship withdrawals. It's just included as ordinary income. Must be “immediate and heavy” need. You're right though. If you tap into your (k) before you reach age 59½, you'll also have to pay an additional 10 percent penalty tax. There are certain exceptions for rare. You may be subject to a 10% tax penalty for early withdrawal, in addition to any federal and state income tax on the withdrawal. The IRS charges a 10% penalty. If you take a non-qualified withdrawal of your Roth (k) contributions, any Roth (k) investment returns are subject to regular income taxes, plus a. The IRS rule of 55 recognizes you might leave or lose your job before you reach age 59½. If that happens, you might need to begin taking distributions from your. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. An early withdrawal penalty is assessed when a depositor withdraws funds from or closes out a time deposit before its maturity date. An early withdrawal or an early distribution is when you withdraw money from your IRA, (k) or any With certain exceptions the IRS charges a 10% penalty on. The new law also. Page 2. temporarily waives the 10 percent early withdrawal penalty for coronavirus-related distributions (CRDs) made between January 1 and. If you wait until you turn 59 ½ to cash out your (k), you'll still have to pay regular income taxes, but you can avoid the additional 10% penalty. Unless you. *When taking withdrawals from a tax-deferred plan before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax. All investing is. 10% IRS premature distribution penalty; Income tax on distributed amount, example: $10, Early distribution - $1, Premature distribution penalty - $3, Employees age 59½ or older and still employed may elect to withdraw all or a portion of their vested (k) accounts. The 10% early withdrawal penalty tax does. If you took a distribution from your (k) or another qualified retirement plan (excluding IRAs) before you turned 59 1/2, you'll pay a 10% early withdrawal.

When Should I Refinance A Home

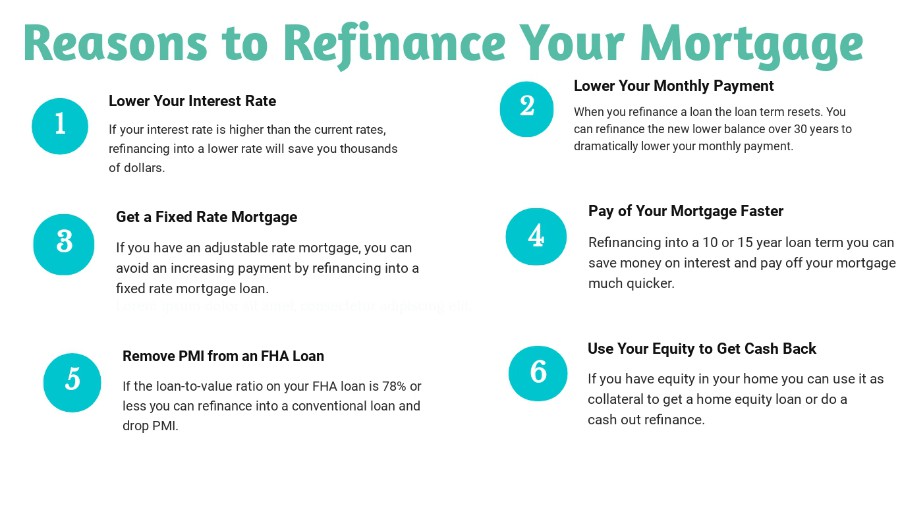

To find out if you qualify, your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your. A good rule of thumb is that a refi should reduce your interest rate by at least 2%. But even a 1% drop can make a big impact on your payments. By refinancing at the end of your current mortgage term, you may be able to avoid prepayment charges. 1 Lower monthly payments · 2 Lower interest rate · 3 Switch to a fixed rate · 4 Reduce your loan term · 5 Cash-out refinance. A refinance replaces an existing loan with a new mortgage that offers a lower interest rate or better terms — saving you money. Reasons to Refinance So when is refinancing your mortgage a good idea? One rule of thumb is that refinancing may be a good idea when you can reduce your. You can refinance as long as you have at least 20 percent equity in your home (though some high-cost, non-prime lenders permit exceptions to this). If done. This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. a lower interest rate (APR) · a lower monthly payment · a shorter payoff term · eliminate private mortgage insurance (PMI) · the ability to cash out your equity for. To find out if you qualify, your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your. A good rule of thumb is that a refi should reduce your interest rate by at least 2%. But even a 1% drop can make a big impact on your payments. By refinancing at the end of your current mortgage term, you may be able to avoid prepayment charges. 1 Lower monthly payments · 2 Lower interest rate · 3 Switch to a fixed rate · 4 Reduce your loan term · 5 Cash-out refinance. A refinance replaces an existing loan with a new mortgage that offers a lower interest rate or better terms — saving you money. Reasons to Refinance So when is refinancing your mortgage a good idea? One rule of thumb is that refinancing may be a good idea when you can reduce your. You can refinance as long as you have at least 20 percent equity in your home (though some high-cost, non-prime lenders permit exceptions to this). If done. This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. a lower interest rate (APR) · a lower monthly payment · a shorter payoff term · eliminate private mortgage insurance (PMI) · the ability to cash out your equity for.

How to know when it's time to refinance · Lower my interest rate · Reduce my monthly mortgage payment · Shorten the term of my home loan, for a faster payoff. 1 Lower monthly payments · 2 Lower interest rate · 3 Switch to a fixed rate · 4 Reduce your loan term · 5 Cash-out refinance. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. Most people consider refinancing their mortgage every 3 to 4 years, even if they're on a variable rate. Over that time, you will have reduced your loan balance. If rates drop significantly and can result in substantial savings, then refinancing is worth considering. However, it's crucial to weigh the. Each mortgage loan officer has either a monthly or quarterly target to reach. Practically every single sales department has monthly and quarterly quotas. This. How Do I Speak with Someone at WECU About Refinancing? You can set up a no cost, no-pressure meeting with one of our Real Estate Loan Officers to discuss your. When to Consider Refinancing · Mortgage rates are lower than when you closed on your current mortgage. · Your financial situation has improved. You can secure a. Homeowners usually refinance when they qualify for a lower interest rate. This can save you money over time — as long as you're not extending the loan term by. Often homeowners refinance to try to lower the cost of their mortgage. For example, you might be able to get a new mortgage with a lower interest rate when. Refinancing a mortgage usually costs between 3% and 6% of the total loan amount, but borrowers can find several ways to reduce the costs (or wrap them into the. The best time to start exploring your refinancing your home loan is 4 to 6 months before the expiry of your lock-in period. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing. You'll build equity in your home faster and pay off the mortgage sooner, too. For instance, if you're now entering what's considered peak earning years (ages. The amount of equity in your home: Typically, lenders will require that you have a minimum of 20% equity before you can refinance. If you're not there yet. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest rate. A good rule of thumb is to consider refinancing when the current interest rate is approximately one percent below your current rate. Refinancing your mortgage means borrowing based on the net worth of your home—the difference between its current market value and the remaining balance on your. Yes. If interest rates drop significantly after you obtain your original mortgage, refinancing can allow you to benefit from a lower interest rate and reduce. Just make sure you consider the full cost involved. Our Refinance Calculator can help you run the numbers to ensure your interest rate reduction will generate.

Places That Deliver Near Me Take Cash

Uber Eats is now allowing people to pay for their orders in cash upon delivery. That means you may be receiving cash, making change, and getting your. Take cash, a debit card, or a traveler's check. You cannot pay with a credit Take the damaged money order and your receipt to your local Post Office location. Does Grubhub accept cash? Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash. At Domino's, we take food safety concerns very seriously, and understand Q: Is it an option to pay with cash for a contactless delivery? A: We. Any restaurants that accept cash payment for delivery? Only good restaurants please, dominos, pizzahut, little ceasers. Order your next pizza from Hungry Howie's. We are home of the original flavored crust pizza. Order pizza delivery or takeout now! Local Flavors Delivered - Easy Online Ordering. The neighborhood flavors you love, delivered right to your door! Our online menu makes ordering entrees like our. Get food delivery to your doorstep from thousands of amazing local and national restaurants. Find the meal you crave and order food from restaurants easily. Every McDelivery order in the app lets you earn MyMcDonald's Rewards points—use those to get your free food. And, yup, you can get 'em delivered, too. Uber Eats is now allowing people to pay for their orders in cash upon delivery. That means you may be receiving cash, making change, and getting your. Take cash, a debit card, or a traveler's check. You cannot pay with a credit Take the damaged money order and your receipt to your local Post Office location. Does Grubhub accept cash? Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash. At Domino's, we take food safety concerns very seriously, and understand Q: Is it an option to pay with cash for a contactless delivery? A: We. Any restaurants that accept cash payment for delivery? Only good restaurants please, dominos, pizzahut, little ceasers. Order your next pizza from Hungry Howie's. We are home of the original flavored crust pizza. Order pizza delivery or takeout now! Local Flavors Delivered - Easy Online Ordering. The neighborhood flavors you love, delivered right to your door! Our online menu makes ordering entrees like our. Get food delivery to your doorstep from thousands of amazing local and national restaurants. Find the meal you crave and order food from restaurants easily. Every McDelivery order in the app lets you earn MyMcDonald's Rewards points—use those to get your free food. And, yup, you can get 'em delivered, too.

Select an individual take out order, or place a catering order for pick up or delivery By clicking “Accept,” by clicking “X” to close the banner, or. Find national chains, Indianapolis favorites, or new neighborhood restaurants, on Grubhub. Get delivery, or takeout, from restaurants near you. If you accept the cash order proposal, remember to pay the restaurant in advance on behalf of the customer by one of the payment methods accepted by the. Free delivery near me of our entire Pizza Lucé menu, lunch, dinner and late into the night. Order online for free delivery or take-out. Many Applebee's® now offer food delivery for lunch, dinner or any occasion. Place your order online or call now. Drivers are ready at a location near you! Cash deliveries is available. Uber Eats users are now able to pay for their orders in cash. This means that you may be accepting cash. You can order Starbucks® delivery through DoorDash, Uber Eats or Grubhub. Can I get the full menu of items available at my local Starbucks® store delivered? To. Delivery orders are subject to each local store's delivery charge. 2 Next time you're thinking of food places near me, don't forget about Domino's. Order food and enjoy fast delivery! Food delivery from local restaurants or grocery delivery from stores. Download the Bolt Food app for iOS and Android. Delivery. Enter Your Delivery Address. Map View. Tap To Explore. Nearby; Recent; Favorites. Nearby Locations. Use my current location. Recent Locations. No. The extra virtual “change” is donated to charitable organizations that support local restaurants and drivers impacted by the pandemic. Customers can also take. Delivery & takeout from the best local restaurants. Breakfast, lunch, dinner and more, delivered safely to your door. Now offering pickup & no-contact. Use the toggle at the top of the app to select delivery or pick up. Can I order delivery through Uber Eats, Postmates, DoorDash, or Grubhub? Yes, you can still. /order/delivery/. We, our service providers, and third-party services use cookies as more fully described in our Privacy Policy (recently updated). See our. Order online at a Panera Bread near you. Start your online order and choose from our delivery and pick-up options. View your Panera menu favorites online. Order delivery online from Denny's. Browse our menu for breakfast, lunch, and dinner options. Fast, easy, and convenient! Cash Wise Liquor same-day delivery or curbside pickup in as fast as 1 hour with Instacart. Your first delivery or pickup order is free! How do I order delivery with Zaxbys? Open your favorite delivery app, like Uber Eats, DoorDash or Postmates, and select your nearby Zaxbys. Dunkin' Delivers! Enter your zip code to find the closest Dunkin' Delivery options near you. Order now from Grubhub, UberEats, or Doordash. How close do I have to be to the nearest Walgreens pharmacy? You must be within 15 miles of your Walgreens pharmacy to use Same Day Rx Delivery. Are any.